Orlen to swap stakes on Norwegian shelf, boosting gas reserves

Orlen-owned PGNIG Upstream Norway will exchange shares in production concessions on the Norwegian shelf with Wintershall Dea Norge. The company said on Wednesday that improving production efficiency and increasing Orlen’s reserves by 0.4 bcm of gas was expected.

According to Orlen, PGNiG Upstream Norway (PUN) has signed an agreement with Wintershall Dea Norge, according to which it will receive an 11.92 per cent stake in the Aerfugl Nord field and a 1.92 per cent stake in the PL211 CS licence, which includes the Adriana and Sabina fields, in exchange for a 3.08 per cent stake in the Aerfugl Nord field. The transaction is yet to be approved by the Norwegian administration.

According to Orlen, the exchange will positively affect the Group’s total recoverable gas resources on the Norwegian Continental Shelf; the company will increase its net resources by 0.42 cm and also gain the opportunity to optimise its production profile.

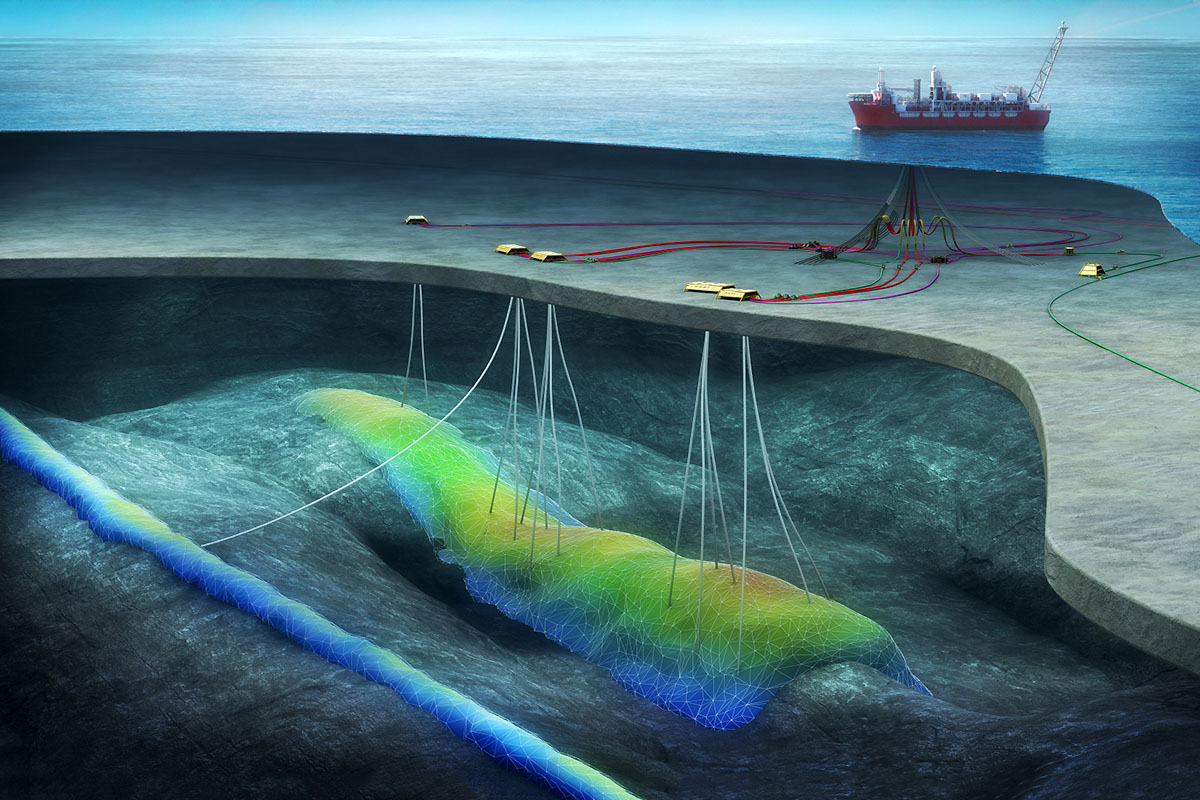

After the swap, PUN’s share in all fields subject to the swap will be 11.92 per cent, the same as in the Skarv field, which is the main hub of Orlen Group’s operations on the Norwegian Continental Shelf. The company said that the unification of shares would allow for synergies, resulting in more efficient management of the entire area and an increase in the value of the block of assets held there.

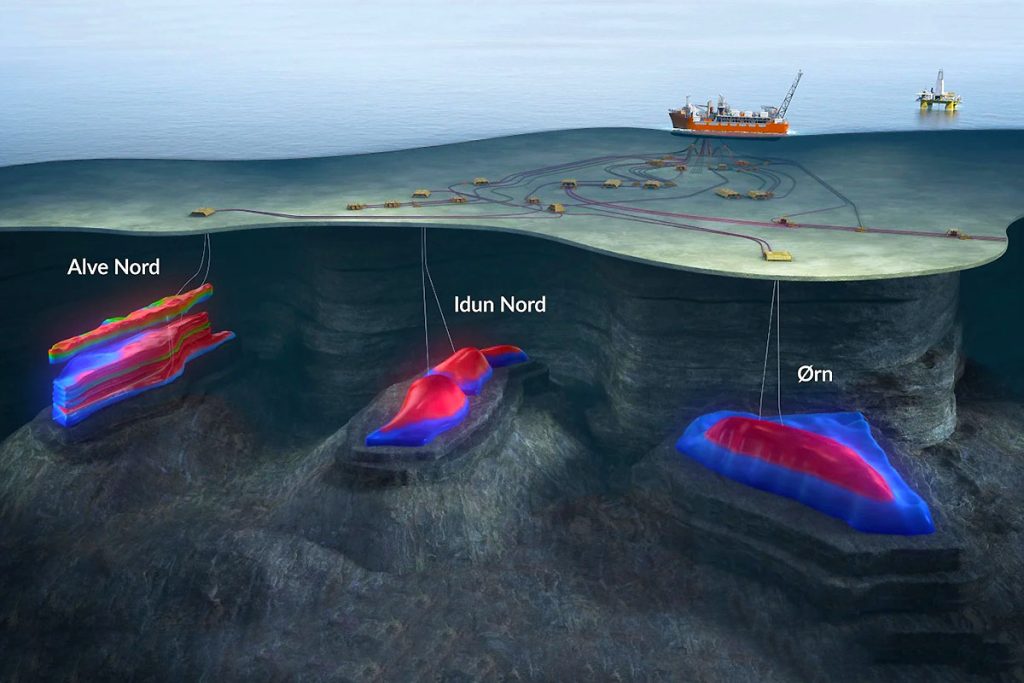

As Orlen points out, the exploitation of the Idun Nord, Adriana, and Sabina fields has not been launched yet. The transaction will allow part of the production to shift to the following years when the productivity of the currently exploited fields will naturally decrease. The transaction will, therefore, contribute to stabilising the volume of gas from our production on the Norwegian Continental Shelf, which is transported to Poland via the Baltic Pipe pipeline, the company explained.

“We have a broad and attractive portfolio of concessions, which we can actively manage by exchanging shares with other companies operating in this market. The overriding aim of these activities is to increase the ORLEN Group’s production capacity, especially for natural gas. The agreement with Wintershall Dea Norge, signed today, will increase our resources on the Shelf by more than 0.4 bcm of gas and will contribute to maintaining a stable level of supplies of this raw material to Poland in the coming years, thus strengthening the country’s energy security,” – Orlen’s CEO Daniel Obajtek stated, quoted in the company’s announcement.

According to Orlen, Idun Nord is a deposit with recoverable resources estimated at 3.3 million cubic metres of oil equivalent. It is dominated by natural gas at three bcm of gas, of which PUN will account for 0.35 bcm. In July 2023, the Norwegian authorities approved the development plan for the field, which will be exploited using the production facilities of the Skarv field. Production is scheduled to start in 2027. Once the transaction is completed, PUN’s partners on Idun Nord will be Equinor, Wintershall Dea Norge and Aker BP as operators.

Source: PortalMorski.pl