Daniel Obajtek dismissed from Orlen board

The company’s supervisory board has decided to dismiss Daniel Obajtek from Orlen’s management board as of 5 February 2024, Orlen said on Thursday.

The Company’s Supervisory Board, having reviewed the letter from the President of the Management Board of ORLEN S.A. Mr. Daniel Obajtek, in which he stated that he “places himself at the disposal of the Supervisory Board, within the scope of his function”, decided to dismiss Mr. Daniel Obajtek from the Management Board of ORLEN S.A. at the end of 5 February 2024,” – Orlen’s stock exchange announcement said.

“Due to the change in the approach of the controlling shareholder and the change in the policy regarding the further development of the company, and in accordance with earlier declarations, on Wednesday, 31 January 2024, Daniel Obajtek, President of the Management Board of Orlen placed himself at the disposal of the company’s Supervisory Board,” – Orlen explained in the communiqué.

Obajtek, quoted in the company’s press release, noted that “Orlen’s further development, its good name and Poland’s energy security” have always been a priority for him.

“I am proud of how the concern has changed in recent years, how important it is for the country and how strong it is becoming abroad. Such development would not have been possible without the work of over 66,000 ORLEN Group employees, whom I thank for their commitment to the projects and investments implemented,” – said the president of the national company.

Obajtek has served as the CEO of ORLEN S.A. since 2018. At a press conference on Thursday, he reported that in 2023, synergies from Orlen’s acquisitions and mergers amounted to around PLN 1.5 billion. As he added, the sources of these synergies were optimisations on supply chains, logistics or oil purchases.

Obajtek argued that none of the Polish companies would have been able to make investments on the scale Orlen was making them after a series of mergers and acquisitions. If it were not for Orlen’s money there would be no means for the government to freeze energy prices, he added.

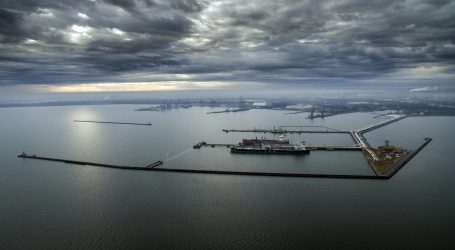

According to Obajtek, it is only through mergers that the conglomerate has secured PLN 20 billion in project financing for offshore wind power. As he added, in the middle of the last decade, petrochemicals in Poland were “residual”. Today, by contrast, investments at Orlen’s Plock refinery alone amount to PLN 45 billion. None of the merged companies on their own would be able to carry out investments on such a scale, he argued.

Source: PortalMorski.pl